In the other important segment, liquid milk (the main product of the dairy sector), Vietnamese companies are temporarily dominating with Vinamilk accounting for nearly 50% of market share. In addition, advantages in terms of cost and preservation time are also helping Vietnamese companies dominate the market in many other dairy related products such as pasteurized milk, yogurt, sweetened condensed milk, with a series of domestic brands such as Vinamilk, TH True Milk, Moc Chau, Ba Vi, Dalatmilk, Lothamilk, Vixumilk and Nutifood.

A majority of milk products in Viet Nam are produced for children under 3 and the elderly while the big market for daily consumption or milk for adults is not invested significantly. The research of Nguyen Viet Khoi (2013) showed that 10% of population in the two big cities of Viet Nam, Ha Noi and Ho Chi Minh City, consumed up to 78% milk products. This is unbalanced in terms of the demand of milk products

The amount of dairy cow in Viet Nam has sharply increased in recent years. According to the General Statistics Office, until the 1st October 2015, it accounted for 257.000 dairy cows, which experienced a growth of 21% compared to 2014. In the last 10 years (2006-2015), the average growth of dairy cows was 11% per year. This expansion has been a positive factor in promoting the production of milk in Viet Nam, which has had the propensity for increasing considerably every year.

Dairy industry is strongly heightening the modernization of dairy cow farms. Viet Nam has also defined a project which meets 60% of domestic fresh milk demand, corresponding to the forecast of population growth to 113 million people by 2045. In order to satisfy this target, the country will have to increase the amount of dairy cow with the production capacity of 5,65 million of ton each year.

Roughly 24.000 households take part of the dairy production chain. This is a major force enabling the development of the dairy industry in Viet Nam, as a medium-scale household farming sustains less pressure in terms of environment compared to large-scale farms. According to the Dairy association of Viet Nam, solely focusing on the development of large-scale farms regardless of developing the household farming would face much difficulties, such as: lack of land, farmers losing land will face difficulties in their livehood, productivity, disease and especially environmental issue.

Forecast of dairy output growth in Viet Nam from 2015-2045:- Period 2015 – 2025: Growth of 12,0%/year.

- Period 2026 – 2035: Growth 5%/year.

- Period 2036 – 2045: Growth 3,0%/year.

Equipment investment and quality management:A large number of enterprises in the industry are investing in modern equipments, updating advanced technology in order to produce high-quality products, ensuring food safety and competitivity in the domestic and foreign market, which satisfy the increasing demand of consumers.

Most of major enterprises in the industry possess the quality management system according to the international standards such as ISO, HACCP...in order to output quality products which ensure food security. Furthermore, there still exist several small enterprises that do not meet the quality and food safety.

The real situation of equipments, technology and quality management and food safety of enterprises in the dairy processing industry is as follows:

Equipment, technologyMost of dairy factories were invested after 1990 with integral and modern investment scale. Comprehensive production line as well as advanced technology are imported from countries that possess developed technology and dairy equipments such as Sweden, Danemark, Germany, Italy, Swizerland...alongside with automatic and semi-automatic self-contained production lines. Enterprises invested the automatic control program into the technological line in order to control closely the technological parameters so the products will have a stable quality and attain the goal as it expected.

Tetra Pak is a Swedish group specialised in providing, installing lines, equipements for the dairy industry in Viet Nam. Between 2007 and 2015, Tetra Pak Group installed the automatic sterilized milk packaging machine system for most of dairy factories (357 equipments); installed integrally 25 sterilized milk processing line, 3 yogurt processing lines, soya milk processing lines; installed 32 main sterilized milk processing equipments, 16 pasteurized milk processing equipments, 25 sterilized sinks, 15 mixers, 22 CIP devices and 42 anabolic equipments.

The majority of dairy enterprises invest in importing comprehensive equipment line, somehow other enterprises only import the main equipments, other equipment such as milk tank, boiler system, water treatment system, etc. purchased from domestic companies such as Polycochemical Refrigeration Electrical Engineering Company (POLYCO), Eresson Refrigeration Electrical Engineering Corporation, etc.

In recent years, concerning the packaging field, enterprises in the industry have invested in renovating comprehensive production lines, modern equipments in diversification of packaging, which use sterilized paper packaging to pack the product. This type of packaging possesses a special composition of 6 layers that allow to protect against harmful effects from light, air, humidity in the air in the storage process of the product. Nowadays, Viet Nam only has 2 exclusive paper box cover suppliers which are Tetra Pak Group ad Combiblock (Germany). In 2005, Dutch Lady Ldt. (FrieslandCampina Viet Nam) invested a bottling line with a most advanced technology in the world. In 2008, Nutifood invested the latest production line of powdered milk, with equipments provided by WOLF (Germany), which is totally automatic in terms of can sanitary and sterilization, finished product, including the injection of inert gas during the extraction process to limit oxygen in the product, increasing the shelf life of milk.In 2013, Vinamilk inaugurated a baby powdered milk factory in Viet Nam, which required a total capital invested at 2.000 billion VND, having a capacity of 54,000 tons of powdered milk per year and is one of the most modern and efficient factories in Asia.

Concerning the production technology, liquid milk product in Viet Nam is currently processed and packaged in 2 forms which are pasteurization and sterilization. Sterilization (UHT) technology is simply understood as a heat treatment process for high temperature milk (130-150oC) in very short time (3-15 seconds) in a closed sterile environment. Thanks to this technology, pasteurized milk retains many nutrients, can be stored at normal temperature and can last from 6 months to 1 year. Fresh pasteurized milk is heated at 85-90oC for a short time (30 seconds - 1 minute) and then cooled. Throughout the process, almost all the vitamins and minerals found in primordial milk are guaranteed. Pasteurized milk must be stored continuously in cold conditions (at 4 ° C) and have a shelf life of only 7 days.

It is feasible to pasteurize and sterilize milk inside or outside the packaging product. While pasteurizing and sterilizing inside the package, people poured milk into glass or plastic packaging, closed the lid and then paste into pasteurizing or sterilizing equipment. When using pasteurization or sterilization, we use paper packaging. The milk is pumped into the heat treatment equipment, heated to keep heat and cool, then transferred to the intermediate and pumped into the pouring equipment. All packaging and equipment in the filling line must be sterilized.

Concerning the yogurt production, Viet Nam puts into practice a large number of different technologies in order to ferment the yogurt such as the use of natural lactic acid fermentation or the use of milk hydrolysis enzymes and the addition of thickening additives. Supporting the modern fermentation technology in major enterprises is the automatic fermentation equipment system which is controlled automatically to ensure the technological parameters of fermentation temperature, ventilation mode, microbial density, pH, sterilization mode. Yogurt fermented yeasts of different enterprises are different and are mainly imported from France, Denmark, Holland to create the unique product flavors of each enterprise.

In the powdered milk production, there have been innovations in technology in the drying and extraction of cans such as spray drying from spraying technology to gas blowing technology; pumping nitrogen gas, hydrogen gas into the packaging to limit oxygen in the product.

Quality management and food securityMain enterprises with trade mark and modern processing systems in the industry have been building quality management systems according to ISO international standards. In 1999, Vinamilk applied Quality Management System ISO 9002 and is currently applying Quality Management System ISO 9001: 2000. Dutch lady ltd (currently FrieslandCampina Viet Nam) received the ISO 9001 certificate in 2000 and the HACCP certificate in 2002. The Hanoi Milk Ltd. received the ISO 9001 certificate in 2000 and the HACCP certificate in 2004. Nowadays, several companies have applied the quality management system VSATTP according to the ISO 22.000 standard. The ISO and HACCP are internationally standardized standards that are now universally applicable to food manufacturers. These standards show the production and provision capacity of products which possess the highest quality of food sanitary and safety for the consumers’ benefit. HACCP is also considered as a passport for the food importing enterprises.

Enterprises take much interests in quality product from the supply of raw materials. Concerning powdered milk, enterprises usually select leading and reliable raw materials suppliers in the world. As for fresh milk, the quality of milk is checked directly at livestock producers and dairy transfer agents, which apply the reward regime to the purchasing price of milk for household that possess good quality milk.

All stages of milk production are controlled by a team of experienced engineers and specialists. All products are strictly controlled by food sanitary and safety standards and ISO quality management system. The batches of products are fully tested by microbiological and physico-chemical criteria from input materials, semi-finished products and finished products in parallel with sampling. The system of microbiological and physico-chemical laboratories has enough equipment for analyzing the parameters and checking important parameters in the entire production process.

In addition, there are still small manufacturing facilities, cramped warehouses and simple packaging equipment that have imported powdered milk (finished and semi-finished) for packaging and sale while not guaranteeing food sanitary and safety standards, the product quality is not inspected and controlled.

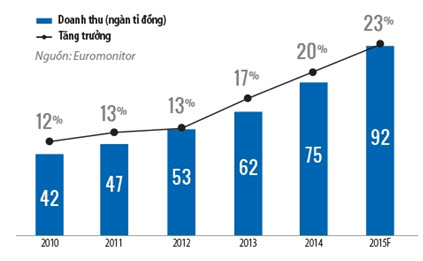

ConsumptionThe Vietnamese dairy market is growing rapidly in recent years and still has growth potential. After the steadiness in 2011 and 2012, the sector's revenue had started to rise sharply by 2013. Growth rate of the industry next year is higher than last year, at average 17% per year in the period of 2011-2015.

In 2014, according to the assessment of Euromonitor International, the dairy revenue in Viet Nam reached 75,000 billion, which increased by 20%. By 2015, total revenue is expected to reach 92,000 billion VND, which went up by 22.7% compared to the previous year, more than doubled compared to 2010 (accounted for 42 trillion VND), the highest in history sector.

In just six years from 2008 to 2014, a person's monthly spending more than doubled from 792,000 VND to nearly 1.9 million VND. Remarkably, out of spending, the Vietnamese are using more and more money spending on food, including milk eventually. For nearly 1.9 million of Vietnamese, each of them can spend up to half of this amount on food, a rate that has improved considerably compared to 2007.

Dairy sales growth in Viet Nam

As a densely populated country with a high population growth rate of 1.2% per year, the dairy market in Viet Nam is always considered to have great potential. The GDP growth rate represents 6% - 8% per year, income per capita increased by 14.2% per year, combined with the tendency to improve the health and stature of the Vietnamese, resulting in the constant high growth of demand for consumption of dairy products. The average milk consumption per capita of Viet Nam in 2015 was about 23 liters per person per year, while in 2010 it was 12 liters per person per year. For the period of 2010 - 2015, on average, each Vietnamese consumed roughly 15 liters of milk per year. In the coming years, the dairy industry will have great potential as demand is expected to grow by 9% per year, reaching 27-28 liters per capita per year by 2020, nearly double compared to the current situation. Currently, the consumption of milk per capita in Viet Nam is still low compared to other countries in the region and the world.

Among fast-moving consumer goods sectors, the dairy industry, including powdered milk and fresh milk, is also showing a strong double-digit revenue growth. And according to the general trend of the world market, Viet Nam's dairy industry is still in a bull market. It can be said, the dairy market is experiencing unprecedented growth in recent years with growth next year higher than last year. Dairy products contributed 13% of total consumer goods. But the huge profits that come from the dairy industry are now shifting market share to foreign dairy companies and foreign suppliers.

In fact, the potential consumption of Viet Nam dairy market is still considered to be very large and does not expect to cease.

Sales and consumption of milk per capita for the period 2010-2015

Source: Euromonitor International

As before, looking at shelves selling powdered milk in supermarkets, it is easy to see the dominance of foreign milk despite the constantly increased price owing to the merits of brand and resources. But in recent years, this gap has been significantly reduced, many domestic dairy firms has good consumption level.

The value of powdered milk is estimated to account for 45% of the Vietnamese dairy market at an average annual growth rate of 10.1% for the period 2010-2013, but by 2014-2015 it tended to decrease, especially in milk consumption in urban areas.

Import

With low dairy cow production, Viet Nam is heavily dependent on dairy imports. Recently, despite the high growth rate of dairy cow in Viet Nam, it is still one of the 20 biggest importers of dairy milk in the world. Over the years, Viet Nam's imports of milk and dairy products have increased steadily and surpassed 1 billion USD in 2013, reaching 1.1 billion USD, an increase of 130% over the same period last year. By 2015, imports of milk and dairy products will show signs of decline (with a total import turnover of 900.7 million USD, decreasing by 18% compared to 2014).

Monthly import of milk and dairy products

Unit: million USD

Source: General Statistics Office

In 2015, New Zealand is still the main supplier of milk to Viet Nam with 24% (216.3 million USD), followed by the United States with 14.6% (131 million USD). Other big dairy markets for Viet Nam are Singapore, Thailand, Germany, Ireland, Australia, Netherlands, France and Japan. However, Viet Nam's dairy imports are expected to increase sharply, reaching 3.6 billion USD by 2045.

Structure of Viet Nam's dairy import market in 5 months of 2016

100% fresh milk in Viet Nam is still limited, due to the number of domestic herds which are only enough to supply about 30% of the country's demand. Even in the amount of fresh milk purchased by the farmer, 20-50% of the milk did not meet the required quality (according to a report from the Institute of Policy and Strategy for Agriculture and Rural Development). In addition, the source of fresh milk purchased also has to be used in many other products, not only serve exclusively for the production of liquid milk.

As a result, the lack of 70% of milk for processing and consumption has made Viet Nam join the group of 20 largest dairy importers in the world. This more or less pushes Viet Nam's dairy industry into dependency and risk, and actively enhances the foreign sector. Mead Johnson, Abbotts and Friesland Campina are the three major milk importers, accounting for 67% of the milk powder market.

Most of the powdered milk imported into Viet Nam is processed into reconstituted milk. This has been misleading to consumers when consuming liquid milk products, they can not distinguish between fresh milk and powderedmilk.

The types of milk imported into Viet Nam are very diversified, including modified whey powder, cream milk, liquid yogurt, butter, cheese and curd, condensed milk and cream, etc.

Import turnover of several types of milk and milk products in 5 months 2016

Unit: USD