Vietnam is the third largest footwear manufacturing country in Asia after China, India, and places fourth in the world. Currently, Vietnam is producing about 920 million pairs of shoes annually and exporting more than 800 million pairs to more than 50 markets around the world, of which European Union (EU) accounts for the largest proportion. Handbag products are also exported to 40 countries, of which the US market accounts for the highest rate of 41.6%.

1. ProductionAccording to the General Statistics Office (GSO), GDP for year 2016 is 6.21% which is lower than 6.68% in 2015 and 6.7% - the goal set by the National Assembly. Production index of the whole industry in 2016 increased by 7.5% in comparison with the same period of 2015, of which the processing and manufacturing industry increased by 7.2%.

The production index of leather and footwear industry in 2016 is only 3.7% higher than in 2015, much lower than the levels of 17.4% in 2015 and 22% in 2014. Low growth of leather and footwear production occurs partially due to global economic fluctuations in 2016, demand in the world market is declining, especially in the EU. In the domestic market, the difficult economic situation, natural calamities, floods, etc. also reduce the demand. Estimated footwear production in 2016 reached 1100-1150 millions of pairs, of which export accounts for about 90% and domestic consumption - 10%. FDI enterprises account for 80% of the industrial production value of the sector.

The regions where many leather and shoe factories are located are:

- In the south of Viet Nam: Ho Chi Minh City; Binh Duong, Dong Nai, Ba Ria Vung Tau, Long An, Tien Giang, Can Tho provinces: producing leather, shoes and bags of all kinds. Ho Chi Minh City, Binh Duong Province, Dong Nai has the largest footwear production in the country.

- The North of Viet Nam: Thanh Hoa, Hai Phong, Hai Duong, Hanoi, Ninh Binh, Thai Binh, producing shoes and bags of all kinds. Thanh Hoa is the province with the largest footwear production in the northern provinces.

- Central area of Viet Nam: Da Nang, Quang Nam, producing footwear and handbags; Khanh Hoa (products from crocodile skin, handbags).

In order to take advantage of the opportunities and overcome the challenges of integration, domestic footwear enterprises must strive for self-improvement, change their production models, invest in equipment and technology innovation, actively integrate themselves to join the global supply chain.

2. Export

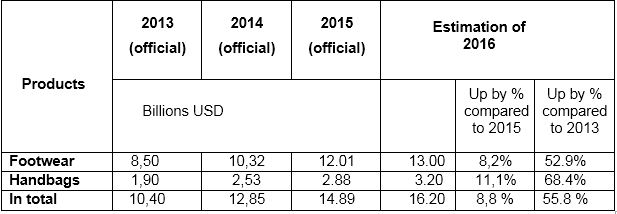

According to the preliminary data by the General Department of Customs, it is estimated that in 2016 the total export of footwear, leather and handbag industry will reach 16.2 billion USD, up 8.8% compared to 2015, lower than the rise of 23.6% (2014 vs 2013) and an rise of 16% (2015 vs 2014). Exports of leather and footwear sector account for over 9% of total export turnover of whole country in 2016. Of which, footwear exports were estimated at 13 billion USD, up 8.2% and handbags and leather products were estimated at 3.2 billion USD, up 11.1% compared to 2015 (illustrated in table 1). Exports of shoes ranked 4th and exports of suitcases, handbags and bags ranked 10th in the list of top 10 export items of Vietnam.

Table 1. Export turnover of leather and footwear industry in 2016

(Stats by the General Department of Customs)

In 2015, exports of FDI enterprises accounted for 78.6% of the total export turnover of the footwear industry. FDI enterprises accounted for 79.1% for the total export of footwear and 76.7% - handbags. In the first 11 months of 2016, exports of FDI enterprises continued to increase, accounting for 80.8% of the total export turnover of the whole sector, of which FDI enterprises accounted for 81.0% for footwear and 80.3% for handbags. Exports of the FDI sector have shown high growth as FDI enterprises tend to expand their existing plant capacity and build new plants in Vietnam to take advantage of benefits from tariff reductions under FTAs.

Meanwhile, due to difficulties in capital sources and difficulties in market access, domestic enterprises are slow to expand production, causing the proportion of domestic enterprises to continue the declining trend in the coming years. The share of domestic exports of leather and footwear has fallen from 25% in 2013 to just over 19% in the first 11 months of 2016.

Table 2. Exports of FDI enterprises from 2013 – 2016

| FDI enterprises | Total | Footwear | Handbags - bags | |

| Billion USD | Proportion | Billion USD | Proportion | Billion USD | Proportion |

| 2013 | 7.80 | 75.0% | 6.43 | 75.6% | 1.37 | 72.1% |

| 2014 | 9.70 | 74.3% | 7.91 | 76.6% | 1.79 | 70.7% |

| 2015 | 11.75 | 78.6% | 9.55 | 79.1% | 2.21 | 76.7% |

| 2016 (11 months) | 11.74 | 80.8% | 9.45 | 81.0% | 2.29 | 80.3% |

Table 3. Export of domestic firms from 2013 – 2016

| Domestic firms | Total | Footwear | Handbags - bags |

| Billion USD | Proportion | Billion USD | Proportion | Billion USD | Proportion |

| 2013 | 2.60 | 25.0% | 2.07 | 24.4% | 0.53 | 27.9% |

| 2014 | 3.15 | 25.7% | 2.41 | 23.4% | 0.74 | 29.3% |

| 2015 | 3.20 | 21.4% | 2.53 | 20.9% | 0.67 | 23.3% |

| 2016 (11 months) | 2.78 | 19.2% | 2.22 | 19.0% | 0.56 | 19.7% |

3. Export markets

Footwear:

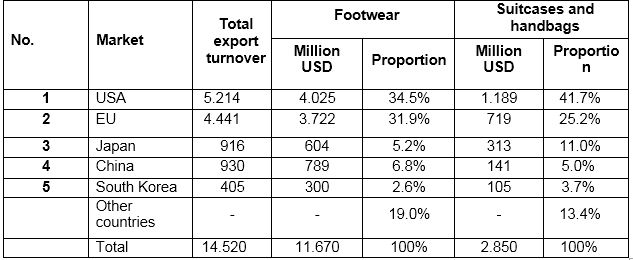

In the first 11 months of 2016, USA is the largest footwear export market of Vietnam, reaching the turnover of 4,025 million USD, up 9% compared to the same period of 2015 and accounting for 35.1% of the total export turnover of all kinds of footwear. EU market ranked second and reaching the turnover of more than 3,728 million, up 4% and accounting for 31.70% of total export turnover.

Handbags:

China had the turnover of 789 million USD, up 12.6% and accounted for 6.6%; Japan - 604 million USD & 5.3%, South Korea 300 million USD & 2.6%. Those five markets account for 81.3% of Viet Nam's total footwear export. In the first 11 months of 2016, the United States was the leading export market, reaching the turnover of 1,189 million USD, up 35.6% compared to the same period last year and accounted for 41.9% of the total export turnover of bags of all kinds in Viet Nam.

EU had the turnover of 719 million USD, up 26.9% and accounted for 25.1%; Japan - 313 million USD, up 40.4% and accounted for 10.9%; China - 142 million USD & 4.9%, and South Korea - 105 million USD and 3.8%. The five markets accounted for 86.6% of Vietnam's total export turnover of suitcases, handbags and bags.

Table 4. Top 5 export markets in 11 months of 2016

Table 5. Export markets by region (11 months of 2016)

(Stats by the General Department of Customs)

Table 6. Export of footwear products (by footwear upper materials)

Unit: Million USD

Table 7. Types of handbags

Unit: Million USD

IMPORT OF PREPARED LEATHER AND SPARE PARTS

In the first 11 months of 2016, Vietnam imported prepared leather of value over 1429 million USD, up 24% compared to the same period of 2015, mainly from China (260 million USD), South Korea (174 million USD), Italy (165 million USD), Thailand (146 million USD), Taiwan (149.3 million USD), etc. In the 11 months of 2016, imports of equipment and spare parts reached 156 million USD, up 4% compared to the same period in 2015, mainly from Taiwan, China and South Korea.

Table 8. Import turnover of prepared leather and equipment and spare parts

Table 9. Import of prepared leather and leather materials (HS:4107-4115)

| Market | 2013 | 2014 | 2015 | 11T-2016 |

| (1000 USD) |

| South Korea | 166.412 | 193.583 | 200.917 | 173,744 |

| Taiwan | 134.981 | 152.921 | 147.991 | 149,241 |

| Thailand | 102.187 | 127.168 | 150.660 | 146,139 |

| India | 68.605 | 94.861 | 91.244 | 78,909 |

| China | 84.154 | 160.932 | 247.090 | 259,149 |

| Italia | 99.703 | 136.371 | 144.604 | 164,881 |

| Brazil | 22.448 | 70.691 | 80.370 | 133,368 |

| Pakistan | 17.156 | 24.420 | 23.812 | 21,270 |

| Hong Kong | 14.466 | 16.870 | 16.092 | 19,956 |

| Uruguay | 3.510 | 4.768 | 2.901 | 4,116 |

| Indonesia | 20.281 | 19.520 | 17.975 | 15,496 |

| Germany | 1.567 | 3.775 | 12.493 | 9,537 |

| USA | 1.734 | - | - | 88,177 |

| New Zealand | 8.343 | 29.885 | 24.969 | 22,112 |

| Australia | 4.458 | 4.338 | 8.512 | 20,763 |

| Other markets | - | - | - | - |

| Total | 827.119 | 1.136.768 | 1.242.615 | 1.428.591 |

Analysis & Reports